In the fast-evolving world of cryptocurrencies, Bitcoin has long stood as the dominant force, but recent trends show a growing interest in altcoins—alternative cryptocurrencies beyond Bitcoin. These digital assets are not just novelties; they represent innovative technologies and offer various use cases that appeal to different segments of the market. In this blog post, we’ll explore why altcoins are gaining popularity, uncover emerging trends, and provide insights into this exciting aspect of the cryptocurrency landscape.

1. Diversification and Innovation – AltCoins

They are gaining popularity because they offer diversification and innovation beyond Bitcoin. While Bitcoin is mainly a digital store of value, altcoins often bring unique features and technologies.

- Ethereum (ETH), for instance, brought the concept of smart contracts to the forefront, enabling decentralized applications (dApps) and smart contract execution. This has created a robust ecosystem for DeFi (Decentralized Finance) applications and NFT (Non-Fungible Token) markets.

- Cardano (ADA) and Polkadot (DOT) focus on scalability and interoperability, aiming to address some of the limitations associated with earlier blockchain technologies. Their emphasis on research-driven development and academic rigor appeals to both developers and investors looking for long-term potential.

These features let investors and developers explore different parts of the cryptocurrency space, from finance to digital art. This creates a wide range of possibilities.

2. Rising Institutional Interest

Institutional interest in cryptocurrencies has surged in recent years, and altcoins are no exception. As more traditional financial institutions and corporate investors enter the space, they are not solely focusing on Bitcoin. Instead, they are diversifying their portfolios to include promising altcoins.

- Grayscale Investments, for example, has launched several altcoin trusts, including those for Ethereum and other prominent altcoins. This institutional endorsement provides credibility and attracts more mainstream investors to the altcoin market.

- Major companies like PayPal and Square have also integrated altcoins into their platforms, further legitimizing and expanding their use. This institutional backing helps stabilize altcoin markets and encourages widespread adoption.

3. DeFi and NFT Boom – AltCoins

The decentralized finance (DeFi) and non-fungible token (NFT) revolutions have played a significant role in elevating the profile of altcoins.

- DeFi platforms such as Uniswap, Aave, and Compound operate primarily on Ethereum, leveraging its smart contract capabilities to offer decentralized lending, borrowing, and trading services. These platforms have grown rapidly, drawing attention to Ethereum and other altcoins that support similar functionalities.

- NFTs have become a cultural phenomenon, with platforms like OpenSea and Rarible enabling the creation and exchange of digital collectibles and artwork. Altcoins such as Polygon (MATIC) and Flow are designed to enhance the NFT experience by offering faster and cheaper transactions.

These trends highlight how altcoins are not just competing with Bitcoin but are carving out their niches by addressing specific needs and creating new market opportunities.

4. Technological Advancements

Technological advancements and improvements in blockchain technology contribute to the growing popularity of it. Innovations in consensus algorithms, scalability solutions, and privacy features make altcoins more attractive to both developers and users.

- Proof-of-Stake (PoS) and Proof-of-Authority (PoA) are alternatives to Bitcoin’s energy-intensive Proof-of-Work (PoW) consensus mechanism. It like Tezos (XTZ) and Algorand (ALGO) utilize these more energy-efficient models, appealing to environmentally-conscious investors and developers.

- Privacy-focused altcoins such as Monero (XMR) and Zcash (ZEC) offer enhanced privacy features that cater to users concerned about transaction anonymity and data protection.

These technological improvements make it more versatile and appealing to different user bases, fostering innovation and broader adoption.

5. Community and Ecosystem Growth – AltCoins

The growth of altcoin communities and ecosystems significantly contributes to their rising popularity. Enthusiastic communities drive development, marketing, and adoption, creating a strong network effect.

- Chainlink (LINK) has built a robust ecosystem of decentralized oracles, enabling smart contracts to interact with real-world data. Its active community and integration with numerous DeFi platforms have cemented its role as a crucial infrastructure component.

- Shiba Inu (SHIB), initially launched as a meme coin, has grown into a community-driven project with its decentralized exchange (ShibaSwap) and a developing ecosystem. This vibrant community engagement helps sustain interest and investment.

These communities provide support, resources, and advocacy, helping it gain traction and visibility in the broader cryptocurrency market.

6. Market Speculation and Investment Opportunities

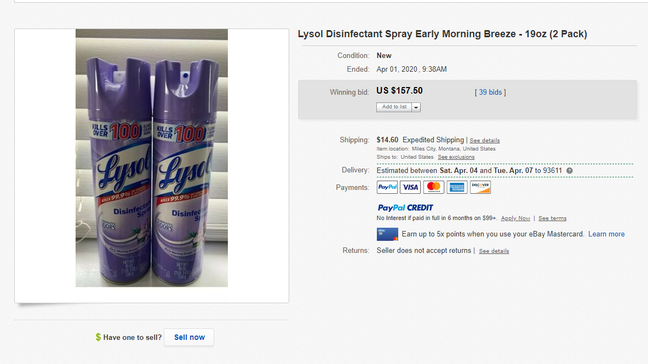

Market speculation and investment opportunities also play a role in the growing popularity of it. The potential for significant returns attracts both retail and institutional investors to the altcoin space.

- Binance Coin (BNB) and Solana (SOL) have experienced remarkable price increases, driven by their utility within their respective ecosystems—Binance for trading fees and Solana for high-speed transactions. These success stories fuel speculation and interest in other promising altcoins.

- The growing trend of Initial Coin Offerings (ICOs) and token sales provides investors with early access to new altcoin projects, creating opportunities for potential high returns. However, this also introduces risks, highlighting the need for careful research and due diligence.

7. Regulatory Developments and Institutional Support

As the regulatory landscape for cryptocurrencies evolves, they are also benefiting from increased clarity and support. Regulatory developments can provide a framework for the legitimacy and compliance of altcoin projects.

- Recent regulatory clarity in countries like Singapore and Switzerland has encouraged the growth of altcoin projects by providing a more defined legal environment.

- Additionally, some regulatory bodies are working to create frameworks that support the development and adoption of blockchain technologies, including it. This institutional support helps build trust and stability in the altcoin market.

Conclusion: AltCoins

Altcoins are gaining popularity for a variety of reasons, from their innovative features and technological advancements to rising institutional interest and market opportunities. As the cryptocurrency landscape continues to evolve, they are likely to play an increasingly significant role, offering diverse applications and investment opportunities.

For investors, developers, and enthusiasts, keeping an eye on altcoin trends and developments is essential to understanding the future of the cryptocurrency market. With their unique attributes and growing ecosystems, they are set to remain a dynamic and integral part of the digital economy.

Whether you’re looking to diversify your investment portfolio, explore new technologies, or participate in cutting-edge financial applications, the world of altcoins offers exciting opportunities and insights. Stay informed, stay curious, and embrace the future of cryptocurrencies!